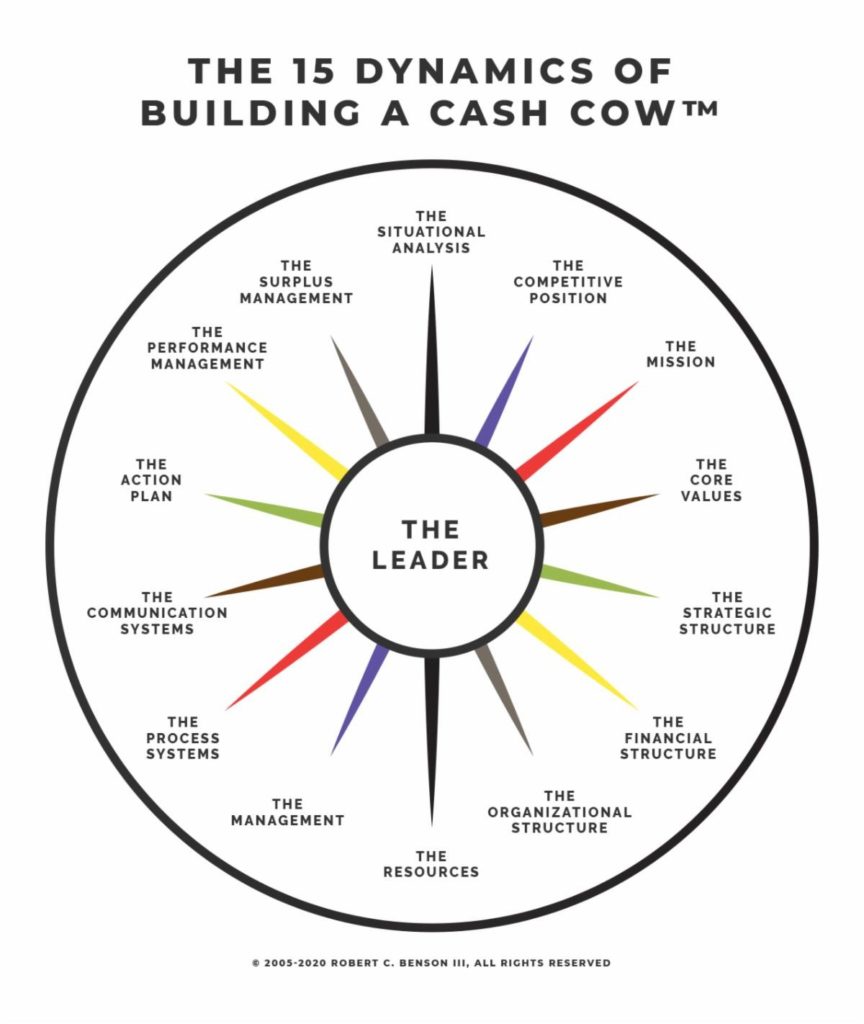

The 15 Dynamics of Building a Cash Cow™ PART 3b

THE COMPETITIVE POSITION

I am writing a series of articles on The 15 Dynamics of Building a Cash Cow™. Most of the articles, including this one, are applicable to both profit and non-profit companies. Note: In this article, we will be examining how Grand Strategies impact your profits, growth, and value. PARTS 3a and 3b have a MAJOR short-term and long-term impact on PROFIT, GROWTH, and your QUALITY OF LIFE!

Recap

IN THE INTRODUCTION, I presented The Driving Principle that “all data is not equal.” Ralph Waldo Emerson noted that “The value of a principle is the number of things it will explain.” Why? Because it is transferable to many applications and realms of our life and business. Then I discussed an insight that is even more powerful: “The value of a Driving Principle is the number of things it will do for your company.”

IN PART 1, THE LEADERSHIP, I created the awareness of The Driving Principle: “The leader’s belief system determines the effectiveness of the leader and the company.” Faulty beliefs, of which there are many in the business world, like “formal business planning is a waste of time,” significantly limit your profits and growth.

IN PART 2, THE SITUATIONAL ANALYSIS, it was noted that a sound business plan begins with a situational analysis. The Driving Principle: “To know where you are going, you must first know where you are.” Therefore, we provided the readers with methodologies to perform a competitor analysis, a SWOT analysis, and an external forces analysis.

IN PART 3a, THE COMPETITIVE POSITION, you learned that there are three Core Competitive Strategies and only three! The Driving Principle: “Pick one and give total commitment to it!” You learned how to do an industry forces analysis and pick a Core Competitive Strategy.

What the leader believes to be reality is reflected and integrated into the company through his/her behavior and decisions. I know it is intimidating, but Consider how the beliefs of a U. S. President affect our country, and what effect a governor has on you and the state you live in. Think about the impact leaders of the companies you have worked for had or have on the companies. And the impact your parents had/have on you and your family? My objective is to empower you with sound Driving Principles.

Driving Principles have the power to drive the culture, growth, profits, cash flow, and overall success of your company to the next level and beyond to the top 25% of your industry. Even if you are profitable and growing, if your company’s financial performance is not in the top 25%, it is underperforming. On average, the top 25% of companies make about twice as much profit as the middle 50% and about three times as much profit as the average company. I hope you enjoy putting these Driving Principles to work in your company.

Did you know that most people don’t stop to think about the fact that God’s Son, Jesus Christ, grew up in a family business?

“Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it?” Jesus Christ, Luke 14:28

Grand Strategies

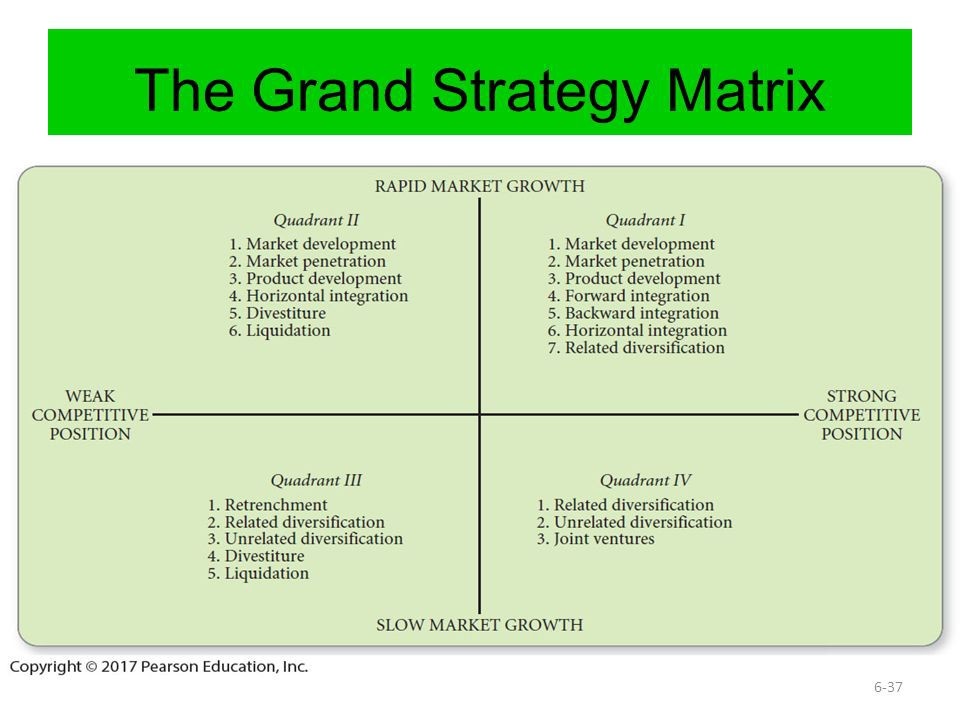

Creating an effective Competitive Position also requires a Grand Strategy. To thrive in good times and bad times, you need to engineer a competitive strategy that is compatible with your strengths and financial resources. This is imperative when picking your grand strategy. There are 16 Grand Strategies summarized below.

“Trust in the Lord with all your heart, and do not rely on own understanding. Acknowledge Him in all your ways, and He will make your paths straight.” Proverbs 3:5-6

RAPID MARKET GROWTH

1. MARKET PENETRATION:

Market penetration refers to the successful selling of a product or service in a specific market. It is measured by the amount of sales volume of an existing good or service compared to the total target market for that product or service. With numerous options available, this matrix helps narrow down the best fit for an organization and its resources.

This strategy, in its pure form, focuses on a single product/service in a single market or multiple products in a single market. Variations of it include focusing the offering of your products/services in a limited market, such as a city or region of the country. For example, offering the subcontracting of electrical, plumbing, dry-walling, concrete, etc. It also includes offering your product(s)/service to a single segment of the market, such as marketing to just women, children, etc. The power of this strategy comes from focusing your resources on a specific market in order to maximize your resources and brand name.

2. MARKET DEVELOPMENT:

Market development is a growth strategy that identifies and develops new market segments for current products/services. A market development strategy targets prospective customers in currently targeted markets. It also targets new customers in new markets. A market development strategy entails expanding the potential market through new users or new uses. New users can be defined as new geographic areas, new demographic areas, new institutional opportunities, or new psychographic focus.

“The first responsibility of the leader is to define reality.” Max De Pree

With this strategy, a company exploits product knowledge in multiple markets. Here, a company capitalizes on its unique product/services design, skill, or knowledge by keeping their products/services offering limited and marketing in many or all potential markets. An example is chain stores that provide chicken, hamburgers, Mexican food, etc. Another way is to expand sales through new uses for the product. The power of this strategy comes from focusing your resources on your brand name, product/service knowledge, or skill in order to maximize them.

3. PRODUCT DEVELOPMENT:

This strategy is more complicated and expensive and involves exploiting your knowledge of the target market by developing related or new products/services to make a full-service offering. Wal-Mart, for example, has moved into everything from household items, banking, eyeglasses, and clothes, etc. in order to make shopping more convenient for its market. The power of this strategy comes from focusing your resources on meeting the needs of your market in order to maximize distribution channels and customer traffic.

4. FORWARD INTEGRATION:

Forward integration is a business strategy that involves a form of downstream integration whereby the company owns and controls business activities that are ahead in the value chain of its industry. This might include among others direct distribution or supply of the company’s products. This type of vertical integration is conducted by a company advancing along the supply chain. A good example of forward integration would be a farmer who directly sells his crops at a local grocery store rather than to a distribution center that controls the placement of foodstuffs to various supermarkets. Or, a clothing label that opens up its own boutiques, selling its designs directly to customers instead of or in addition to selling them through department stores.

5. BACKWARD INTEGRATION:

A strategy used by companies to minimize the dependence on vendors and assure product quality and service is the acquisition of firms that supply them with raw materials or products.

“Truth can never be told so as to be understood, and not be believed.” William Blake

An example of this is McDonald’s, which does everything from raising its own cattle to owning its own stores. The power of this strategy comes from control of the variables and costs that affect its prices and competitive dependencies.

6. HORIZONTAL INTEGRATION:

A strategy that was used a lot before 9/11 and has emerged again in the last decade. It involves the acquisition of businesses that operate in similar industries to increase market share. This is also referred to as “rollups” or “consolidation of an industry.” It requires a lot of resources and has been used in dental practices, hospitals, electronic stores, etc. The power of this strategy comes from allowing a company to “stick to its knitting” while creating enormous growth and economies of scale.

7. RELATED DIVERSIFICATION:

Another master strategy is to own businesses that are related on the basis of similar products/services, market knowledge, or production technology. An example of this is Microsoft, which started by offering an operating system for PCs, and over the years has added products such as software for word processing, spreadsheets, databases, internet access, accounting, computers, and much more. The power of this strategy comes from minimizing risk and maximizing your distribution channels by diversifying into products/services that are related to yours and used by the market you already service.

SLOW MARKET GROWTH

1. UNRELATED DIVERSIFICATION:

A more complicated and expensive master strategy is to use internal capital to expand to businesses that are not necessarily related, but are attractive and offer great opportunities to improve growth and/or profits. Conglomerate diversification occurs when there is neither technological nor marketing synergy and requires reaching new customer groups. This strategy has been used by GE, for example, with operations running the gamut from appliances and auto leasing to the manufacturing of locomotives, jet engines, nuclear reactors, medical systems, generators, etc. The power of this strategy comes from allowing firms in mature markets with excess financial and management capabilities to grow their revenues far more rapidly than they could by sticking to their existing lines of business.

2. JOINT VENTURES:

A joint venture strategy is used when establishing a new company, including investing capital, for a specific mission for the mutual benefit of the co-owners. It is a less risky way to invest capital and acquire the knowledge needed to grow or start a new business venture. It is utilized by many companies and its power is derived from the pooling of resources and knowledge. Strategic alliances, a form of a joint venture, can also be productive. This strategy involves creating an alliance between two or more companies that contribute skills and expertise (not equity) to a cooperative project for a defined period. Strategic alliances are often a much more flexible, less risky, and more cost-effective strategy for venturing into new markets and products, and for broadening your knowledge base and improving performance.

3. RETRENCHMENT:

Retrenchment strategy is a process through which you cut down all of those products and services that aren’t profiting your business to achieve financial stability. It also means leaving the market where your company can’t sustain itself. Also referred to as turnaround, it is a strategy of focusing all resources on the process by which a company in a financial crisis or decline discovers the source of its problems and adapts to new short-term and long-term strategies in order to turn the tide of decline and loss toward growth and renewed value.

“50% of profits and growth potential comes from your competitive position.” Michael Porter

This is usually done by advisors outside the company and involves cutting expenses, selling assets, closing product lines or divisions with losses, etc., and restructuring the financial structure. The most dynamic example of this is Harley Davidson which, on the brink of bankruptcy, hired outside advisors to help re-engineer the business strategies and processes. This resulted in them being the leading motorcycle company in the world. The power of this strategy comes from focusing all resources on renewal.

4. DIVESTITURE:

A strategy to improve value or performance by selling off a business or product line in order to create capital or dispose of a profit center with poor performance. Many large companies employ this strategy and its power is derived from focusing resources on high-payoff activities and profit centers.

5. INNOVATION:

Another powerful but slow and likely expensive grand strategy is innovation. This is another strategy that focuses on the product/service but does it by staying ahead of the competition technologically or through special knowledge, such as Intel, which is known worldwide for being the leader in microchip technology. The power of this strategy comes from focusing your limited resources on being the industry leader with your technology or special knowledge.

6. CONSORTIA:

This is a master strategy involving an association of capitalists for affecting a venture requiring extensive financial resources. It was used in the 1990s by all major automobile companies that contributed billions of dollars to a research project investigating how to design and manufacture a marketable electric automobile. The power of this strategy comes from applying massive resources to accomplish an objective.

7. HARVEST:

A harvest strategy focuses on maximizing cash flow by holding reinvestment in the business to a minimum, or by creating a strategy to maximize the value of the business upon exit, such as an initial public offering (IPO), private sale, or management buy-out. There are many examples of this strategy by businesses that have going out of business sales for months or years. Another variation is a business that stops trying to grow rapidly, lives off its reputation, cuts costs, and maximizes profits for years. The power of this strategy comes from living off the value that has already been expended to develop the business.

8. BANKRUPTCY:

A non-liquidation bankruptcy strategy is used to facilitate the survival of a business by reorganizing debt principal and/or interest payments until later when the company is in better financial condition. United Airlines, Chrysler Corporation, and other major and small companies have used this strategy successfully. The chapter 11 bankruptcy strategy derives its power by protecting its resources under the legal system in order to buy the time to employ a turnaround strategy.

9. LIQUIDATION:

Some businesses employ a strategy of maximizing their value by discontinuing business and selling off in parts to maximize value or liquidate debt. You have probably never heard of most companies that employ this option. The power of this strategy is derived when the value of the pieces is more than the value of the whole.

ACTION STEPS: Consider the Grand Strategies in the matrix above that can be used to create a strong competitive position for your company and select only one as your grand strategy. Then give total commitment to it. Note that you may, from time to time, use other grand strategies for a period of time to support the effective development and implementation of your grand strategy.

Next, you will use your grand strategy and Core Competitive Strategy from PART 3a to write your Competitive Positioning Statement.

“Our view of reality is like a map with which to negotiate the terrain of life. If the map is true and accurate, we will generally know where we are, and if we have decided where we want to go, we will generally know how to get there.” M. Scott Peck, M.D., The Road Less Traveled

Competitive Positioning Statement

You may believe having a strong competitive position is impossible for a small or midsized company. That would be an erroneous belief. Whatever industry you are in, whether a small, medium, big or large company, picking a Core Competitive Strategy and Grand Strategy and giving total commitment to them will transform your business.

SAMPLE CORE COMPETITIVE STRATEGY

We will use a FOCUS core competitive strategy of Differentiation and Low-Cost Leadership concentrating on the customers in our market who desire consistent, high-quality products and customer service.

SAMPLE CORE COMPETITIVE STRATEGY

We will use a Product Development grand strategy supported by a Market Penetration grand strategy to maximize our resources and potential.

SAMPLE COMPETITIVE POSITIONING STATEMENT

We will use a FOCUS core competitive strategy of Differentiation and Low-Cost Leadership to concentrating on the customers in our market who desire consistent, high-quality products and customer service. Our differentiation will include:

- Specialized services of case planning and chair side assistance

- Highly specialized cosmetic training

- Educating the doctors

- Consistency in quality

- On-time delivery

- Quick responses to questions

- Meeting customer specifications

- Value vs price

- Making the doctor look good

- Using cutting edge technology

- Highly specialized implant training

- Only lab with Deming and lean manufacturing training

- Member of an industry CEO pier group

To maximize our core competency, resources, and potential we will use a Product Development grand strategy supported by a market penetration grand strategy.

“…Any enterprise is built by wise planning, becomes strong through common sense, and profits wonderfully by keeping abreast of the facts.” Proverbs 24:3-4 LTB

All of my clients who had a formal competitive positioning statement made it safely through the 2007 Recession. Three of them sold their businesses and retired before COVID-19. Another went public in 2020 and is the 4th largest self-storage company in America with strong profits, growth, and market price.

YOUR VISION AND DRIVING PRINCIPLES

I encourage you to follow along with me as we examine the Driving Principles and beliefs fueling The 15 Dynamics of Building a Cash Cow™. When we are done you will have a valuable blueprint to build your business and accomplish your vision and goals.

Next, in PART 4 we will examine how to write a mission statement that will focus your company, clarify your vision and motivate and focus your employees.

The Lord be with you and keep you safe!

If you have feedback or questions for Bob, email him at bob@CCBAlliance.org. For more information on The Colorado Christian Business Alliance go to CCBAlliance.org. If someone you know would like to receive these BobChats™ email the information to

Robert C. Benson III (Bob) is the co-founder and past President/CEO of American Business Advisors, Inc., a Business strategic, finance, and management advisory firm specializing exclusively in the unique opportunities and issues faced by small and mid-sized companies. He successfully founded or co-founded seven businesses, including being a co-founder and former President of SecurCare Self Storage, Inc., now National Storage Affiliates (NSA), a public company and the 4th largest self-storage company in America. Bob is also the founder and former Managing Partner of the CPA firm, Benson Wells & Co, now Corne Jantz and Associates. Mr. Benson’s credentials include being a CPA*, Certified Management Consultant, and Chartered Global Management Accountant. He is also the author of STAND FIRM WITH GOD’S POWER IN BUSINESS and numerous business and spiritual articles. Bob is married and has two sons and four grandchildren.

* On inactive status

© Robert C. Benson III – All Rights Reserved

™ by Robert C. Benson III