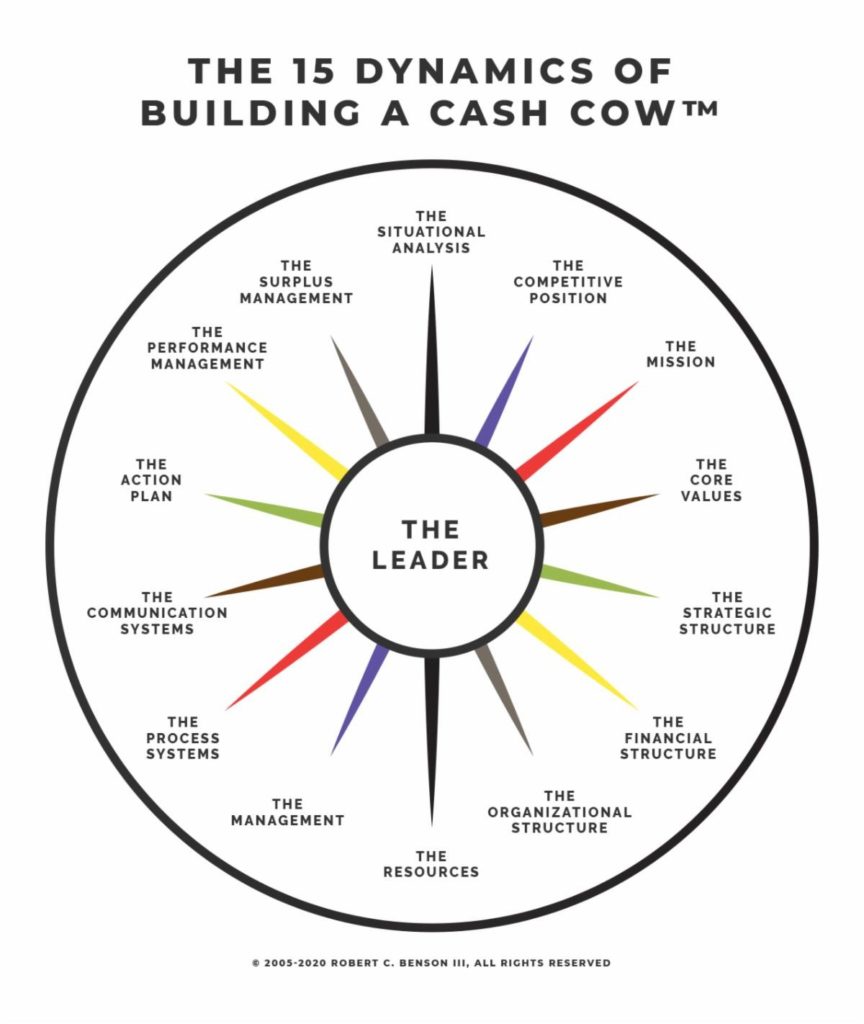

The 15 Dynamics of Building a Cash Cow™ PART 3a

THE COMPETITIVE POSITION

PORTER’S FIVE FORCES

I am writing a series of articles on The 15 Dynamics of Building a Cash Cow™. Most of the articles, including this one, are applicable to both profit and non-profit companies. Note: In this article, we will be examining how industry forces impact your profits and growth and how to develop a Core Competitive Strategy. PARTS 3a and 3b have a major short-term and long-term impact on profit and growth!

Recap

IN THE INTRODUCTION, I presented the Driving Principle that “all data is not equal.” Ralph Waldo Emerson noted that “The value of a principle is the number of things it will explain.” Why? Because it is transferable to many applications and realms of our life and business. Then we discussed the insight that is even more powerful: “The value of a Driving Principle is the number of things it will do for your company.”

IN PART 1, THE LEADERSHIP, I created the awareness of the Driving Principle: “The leader’s belief system determines the effectiveness of the leader and the Company.” Why? Because, “The company is but a shadow of its leader,” Ralph Waldo Emerson. Faulty beliefs, of which there are many in the business world, like “formal business planning is a waste of time,” significantly limit your profits and growth.

IN PART 2, THE SITUATIONAL ANALYSIS, we noted that a sound business plan begins with a Situational Analysis. The Driving Principle: “To know where you are going, you must first know where you are.” Therefore, we provided the readers with methodologies to perform a Competitors Analysis, a SWOT Analysis, and an External Forces Analysis.

What the leader believes to be reality is reflected and integrated into the company through his/her behavior and decisions. Consider how the beliefs of a U. S. President affect our country, and a governor has on you and the state you live in. Or the impact leaders of the companies you have worked for had or have on the companies. And the impact your parents had/have on you and your family? My objective is to empower you with sound Driving Principles.

Driving Principles have the power to drive the culture, growth, profits, cash flow, and overall success of your company to the next level and beyond to the top 25% of your industry. I hope you enjoy putting them to work in your company.

Industry Forces

Creating an effective Competitive Position begins with an Industry Forces Assessment. The Driving Principle: “Some industries are more favorable than others.” Michael Porter, the author of Competitive Strategy and other books used in various MBA programs, says 50% of profit and growth potential come from good competitive positioning.

In PART 2, I introduced you to SMC (small manufacturing company). In 2004, They were concerned about international and national competitors that were moving into their industry in a significant way. SMC was experiencing the threat and power of industry forces. Michael Porter argues that there are five forces in an industry that determine the profit and growth potential and, therefore, the attractiveness of an industry. To thrive in good times and bad times, you need to engineer a competitive strategy to effectively deal with those industry forces. Those five forces are summarized below.

FORCE 1, Degree of Rivalry: Start by looking at how much head-to-head competition there is in the industry. How much does it influence the value, profits, growth, and resources needed to compete in the industry? How many competitors do you compete with in the industry? What is their relative size? How big is the market? Is the market growing or shrinking? How intense is the rivalry?

The better positioned and focused each competitor is, the more likely those competitors will recognize their mutual independence and will restrain the effects of rivalry on them. For example, while the airline industry is very competitive, the major players also uphold certain “informal” rules about which geographic territories or hub markets are “owned” by the various players. Every airline does not try to compete equally in each geographic market or have a major hub in every major city.

On the other hand, if an industry is comprised of a number of small players, each may assume their actions will go unnoticed by the other players and they may each be tempted to grab additional market share, thereby disrupting the market. An example would be wireless telephone service providers now competing in that marketplace.

The presence of one dominant player in the industry may lessen or increase rivalry since the dominant player sets the industry prices and standards based on their current short-term and long-term objectives. A small competitor may be able to ride their coattails and enjoy the dominant player’s price increases. For example, we did that in the self-storage company (SSC) I co-founded and it enabled us to grow and prosper in the early years.

“The first responsibility of the leader is to define reality.” Max De Pree

But one has to be cautious. One of my former clients designed and sold headwear for the golf industry. People liked their creative products, and they grew rapidly. The dominant player in the industry paid little attention to them until my client decided to guarantee five-day delivery and they began to quickly cut deeper into the dominant player’s market share. The dominant player immediately retaliated by also guaranteeing five-day delivery, inhibiting my client’s growth.

Rivalry in industries with a lot of fluctuation in market demand, such as the construction industry, can become very intense during an economic downturn and drive prices down to breakeven or below, forcing many small companies who are not financially strong or well-positioned out of business.

FORCE 2, Threat of New Entrants: Profitability and growth in an industry are influenced not just by existing competitors but also by potential new competitors coming into the market. The key component influencing new competitors entering the industry will be their barriers to entry.

These barriers may include anything that would make it difficult or non-economical for a new player to try to replicate the current incumbents’ position in the industry. Some of the barriers include access to physical or people resources, ability to obtain needed capital; intensive plants, factories, or equipment; and regulatory or legal issues. If incumbents have an outstanding reputation and strong brand recognition, those factors make it more difficult for a new company to enter the marketplace.

Another major factor is that capital-intensive industries tend to make profits primarily based on capacity utilization. Therefore, they are often willing to extend good pricing and payment terms in certain conditions to maximize capacity utilization. For example, the steel industry and automobile manufacturing industry. Profits margins or pricing in these sorts of industries may, therefore, tend to be low.

“Switching costs,” as discussed in FORCE 3 below, can also create difficulty for a new competitor to enter an industry. There is the issue of trust. How long has the new company been in business, is their product or service trustworthy, how much inconvenience will it create? In short, people do not like change.

Finally, another major barrier may be the probability that incumbents will retaliate by undercutting price, adding or increasing value-added services, or establish head-to-head competitive locations to force the newcomer out.

FORCE 3, Threat of Substitutes: This threat is determined to an extent by the “price to performance” ratios of various types of products or services to which customers can turn to meet their needs.

Substitutes are also impacted by “switching costs,” i.e. retraining, retooling, or redesign expenses incurred when a customer switches to a different type of product or service. Finally, what sort of substitute materials are available, and what are their features and benefits?

All five of these forces can create difficult or complex conditions to thrive in. So, in such matters, I always seek God’s counsel for wisdom, knowledge, and understanding. Why? Two reasons. In history, King Solomon asks God for a “discerning heart to govern” and God gave him a “wise and discerning heart.” As a result, Solomon “was sought out by people and rulers the world over for his wisdom and understanding, amazing them with his vast depth of knowledge. 1.” Additionally, in the Bible, the apostle Paul said, “My goal is that they may be encouraged in heart and united in love, so that they may have the full riches of complete understanding, in order that they may know the mystery of God, namely, Christ, in whom are hidden all the treasures of wisdom and knowledge. I tell you this so that no one may deceive you by fine-sounding arguments. “Colossians 2:2-4

Examples of substitutes in the steel or construction industries include plastics, aluminum, ceramics, etc. which may take the place of steel or wood. Examples in the welding supply industry may include adhesive and glues.

The threat of substitutes is also impacted by new technology if that technology provides a lower-cost alternative with the same quality features or a product with new, more desirable features.

Finally, what is the buyer’s propensity to substitute? How loyal is the buyer to a product or brand? For example, the non-loyalty of vacationers’ propensity to shop on the internet for the cheapest flight. Or customers switching to other mobile phone or internet providers who provide a lower cost or better features or buying on the internet instead of going to a store.

FORCE 4, Buyer Power: The most important determinants of buyer power are the size and the concentration of customers relative to the suppliers. The fewer customers a supplier has the more power they have over the supplier’s profits and growth.

For example, auto manufacturers have historically enjoyed considerable leverage in dealing with steelmakers. Other factors include how well-informed customers are of their supplier’s cost structure and of their ability to integrate backward into the supplier’s business. For example, at one point, Ford threatened to open up their own steel mill.

“50% of profits and growth potential comes from your competitive position.” Michael Porter

The larger the buyer is, the more bargaining power they have, such as Walmart, Costco, Ford, etc. The smaller the buyer, the lower their bargaining power is, such as self-storage customers and most small companies in every industry. Many small companies band together with others in their industry to form buying groups in order to compete with big companies.

It is important, however, to distinguish potential buyer power from the buyers’ willingness or incentive to use that power. For example, the U.S. government is potentially a powerful buyer of pharmaceuticals through Medicaid and Medicare, However, historically, they have often refrained from exercising their power. (A situation which can change depending on Congress or the President).

Even small companies can attain some buyer power. One of my clients (about $13M in sales) used only steel in his sub-contractor company and was able to go around his supplier and buy direct from a small steel company.

The interests, motives, and incentives of all players involved must be understood to predict the price sensitivity of a buying decision.

FORCE 5, Supplier Power: Supplier power is the mirror image of buyer power. The focus is on the size and concentration of suppliers relative to industry buyers. The fewer suppliers a company has, the more power those suppliers have over a company’s profit and growth.

It is also based on the threat of forward integration whereby a supplier(s) may dramatically impact the size and concentration of its major buyer. For example, the United Steel Workers union controls the supply of people. Their collective action has historically resulted in wages well in excess of other manufacturing industries while protecting jobs. Or the recent trend in the dental industry where suppliers are going around dental labs and selling equipment to the dental labs so they can make their own crowns.

Relationships with buyers and suppliers have important cooperative as well as competitive elements. GM and other U.S. car manufacturers lost sight of this fact when they pushed their parts suppliers to the wall by playing them against one another. On the other hand, Japanese car manufacturers committed themselves to long-term supplier relationships that paid off in terms of higher quality and faster new product development time.

“Truth can never be told so as to be understood, and not be believed.” William Blake

Since Porter developed his “Five Forces” framework, an additional sixth force has been identified which also influences industry attractiveness. This force is the “Availability of Complements,” most successfully articulated by Adam Brandenburger and Barry Nalebluff in their value net framework (1).

FORCE 6. Availability of Complements: Business success or failure is also influenced by complementors, companies from which customers buy complementary products or services, or to which suppliers sell complementary resources. Complementors are the mirror image of competitors. On the demand side, they increase buyers’ willingness to pay for or accept products or services. On the other side, they decrease the prices that suppliers require for their products or services. For example, Doctors are complementors in that they greatly influence the success of pharmaceutical manufacturers through drug prescriptions.

Complementors seem to be very important in situations where businesses are developing entirely new ways of doing things or where standards play important roles in combining very different kinds of expertise into systems that work well. For example, engineers can significantly impact one company’s success over another by recommending a particular brand of a product that they favor when designing a building, mechanics, electronics, or technical design.

Complementors are more likely to have the power to pursue their own agenda when they are concentrated relative to competitors and are less likely to do so when they are relatively fragmented. When the costs to buyers or suppliers of switching across complementors are high or they have limited options, this increases complementors’ ability to pursue their own agendas.

Customers also can be powerful complementors by encouraging or discouraging new prospects from considering a company or by proactively and enthusiastically recommending a company. For example, graduates of a university can significantly impact the university’s growth or lack thereof.

This is particularly true in business-to-consumer companies in today’s world of purchasing products and services through online search engines. One of my retail clients ($5M in sales) has been so effective in satisfying its customers that 90% of their new business comes from customer referrals.

ACTION STEPS: Considering these forces and the information from the Competitor Analysis you did in PART 2 and use the following grid to do an assessment of your industry.

CONCLUSION: In a relatively ATTRACTIVE industry the strongest reasons to be involved in the industry are (1) low threat of new entrants and (2) little bargaining power of suppliers, (3) not much competition among existing rivals and (4) high barriers to entry. On the other hand, the reverse of these factors makes an industry relatively UNATTRACTIVE.

Core Competitive Strategy

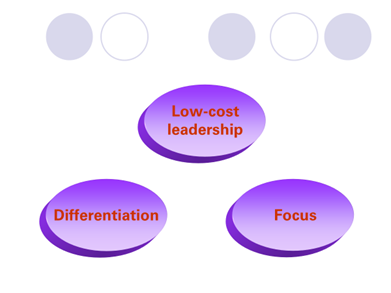

How does one overcome these industry forces? The first step is to select and develop a Core Competitive Strategy. There are only three core strategies!!!

Whatever industry you are in, you should do the industry analysis and use the results to update or develop your competitive position to maximize profits and growth.

This can be done effectively, even in a relatively unattractive industry. SMC, who came to me concerned that international and national competitors were moving into their industry in a significant way, were in an unattractive industry. And as we discussed in PART 2, they developed and implemented a Competitive Position that enabled them to be a Colorado industry leader with a national reputation. It worked so well that their major competitor (the national company) told them “it is impossible to get business away from SMC.”

Let’s examine the components of these three core strategies.

LOW-COST LEADERSHIP

Low-cost of operations relative to competitors becomes the theme! This strategy does not mean reducing expenses. It means your goal is to have the lowest operating expenses in the industry compared to your competitors. Following are the skills and resources needed to accomplish Low-Cost Leadership, and you must give total commitment to them!

- Sustained capital investment

- Process engineering skills

- Intense supervision

- Products designed for ease in manufacturing

- Low-cost distribution system

- Tight cost control

- Frequent, detailed control reports

- Structured organization & responsibilities

- Incentives based on quantitative targets

You may think this is impossible for a small or midsized company. But, consider this, one of the companies I worked with was a small general contractor (SGC), a builder of commercial buildings. Although they had been in business for years, they only had about $10 million in revenue. However, they were realizing 15% in net income before taxes. About 30% of the companies I worked with during my career were in the construction industry. I was amazed! Never had I seen anyone consistently making that large of net profit.

How did they do it? When they got bids from sub-contractors, they didn’t just get bids from 3-5 subs. They got bids from all of the subs in their trade area. “ALL?” I asked. “Yes, we get bids from all of them,” they responded. That policy gave them the lowest operating costs in their industry. We worked together with them to build a strategic business plan to reach their goal of $100M in revenue. Three years later they achieved their goal. Total commitment.

DIFFERENTIATION

Establishing a real differentiation relative to competitors becomes the theme. That may be something like the following:

- Design or Brand Image (this is not a logo, it is what the logo stands for)

- Technology

- Features

- Benefits

- Exceptional Customer Service

- Distribution Network

Following are the skills and resources needed to accomplish Differentiation and you must give total commitment to them!

- Strong value-added marketing abilities

- Innovative Product or service engineering

- A Creative flair

- Strong capability in basic research

- Reputation for consistent quality, exceptional customer service, or tech leadership

- Long tradition in industry or unique skills

- Strong cooperation from all channels

- Strong coordination among functions/departments to deliver the Differentiation

- Use subjective measurement & incentives instead of quantitative measures (this has changed in recent years, most now use both objective and subjective measures)

- Ability to attract highly-skilled, creative people

In my experience, most small companies try to compete using differentiation as a competitive strategy. But how many really accomplish it at a top 25% level? I have worked with hundreds of companies and they all believe they provide better quality products and customer service than their competitors. No one gets up in the morning and says, “I’m going to do crappy work today.”

This was true of SMC who worked in the dental industry. They were very successful in competing against other small companies. But when national and international companies targeted Colorado and started competing against them, they needed a more powerful competitive strategy to sustain their profits and growth. We helped them design one. They were already one of the largest companies and had a reputation for quality and creative products, including standing behind their products if there was a problem.

“Our view of reality is like a map with which to negotiate the terrain of life. If the map is true and accurate, we will generally know where we are, and if we have decided where we want to go, we will generally know how to get there.” M. Scott Peck, M.D., The Road Less Traveled

After hours of brainstorming, SMC decided to provide the dentist with a complimentary chairside consultant for complex implants and other dental cases. Then, the President and co-owner of the company went to a Lean Manufacturing Conference and read the book. He implemented Lean Manufacturing, with a continuous improvement policy. This enabled them to manufacture jobs quicker and with fewer rework jobs. It also made it possible for them to decrease turnaround time, enabling them to provide two-day turnaround. All features the national and international competitors could not duplicate. It worked so well that those competitors found it almost impossible to get business away from SMC. A few years later they had grown by 100% very profitably and sold the business for about a ten multiple of EBITDA.

FOCUS

Here, focus (on a Market, Niche, Product/Services, region, etc.), relative to competitors, becomes the theme. Following are the skills and resources needed to accomplish Focus.

- Serve a Particular Target Very Well

- Design and Develop Each Functional Policy Around Target

- Achieve Either Differentiation, Lower Cost, or Both in Your Target Market (doing both is very difficult and expensive for small companies)

DRIVING PRINCIPLES

- Select One!

- Give Total Commitment to it!

SSC, SGC, and SMC all used a Focus Core Competitive Strategy. SSC is now the 4th self-storage company in America. SGC focused on government buildings with a Low-Cost Core Competitive strategy and building buildings that were very user friendly for the people who worked in them. SMC focused only on dentists in their state who were not just price shopping and provided them with value-added services, consistent quality products, and fast turnaround times.

Another of my clients, a small engineering company (SEC), focused on hospitals only. And they developed the ability and reputation of engineering very safe hospitals for the patients and medical staff, on time and on budget. Although they were headquartered in Colorado, one of their clients was one of the largest hospital groups on the east coast.

By the way, all of these companies made it safely and profitably through the 2007 recession. SMC and SEC sold their businesses and retired before COVID-19. I didn’t stay in touch with SGC so have no info on them.

ACTION STEPS: Select and write down your Core Competitive Strategy. Now you are ready for PART 3b of THE COMPETITIVE POSITION.

YOUR VISION AND DRIVING PRINCIPLES

I encourage you to follow along with me as we examine the Driving Principles and beliefs fueling The 15 Dynamics of Building a Cash Cow™. When we are done you will have a valuable blueprint to build your business and accomplish your vision.

Next, you will be using the outcomes from above in PART 3b of THE COMPETITIVE POSITION to develop or update a competitive Position.

Best wishes and stay safe!

HAPPY NEW YEAR!

If you have feedback or questions for Bob, email him at bob@CCBAlliance.org. For more information on The Colorado Christian Business Alliance go to CCBAlliance.org. If someone you know would like to receive these BobChats™ email the information to clancaster@abadvisors.com.

Robert C. Benson III (Bob) is the co-founder and past President/CEO of American Business Advisors, Inc., a Business strategic, finance, and management advisory firm specializing exclusively in the unique opportunities and issues faced by small and mid-sized companies. He successfully founded or co-founded seven businesses, including being a co-founder and former President of SecurCare Self Storage, Inc., now National Storage Affiliates (NSA), the 4th largest self-storage company in America. Bob is also the founder and former Managing Partner of the CPA firm, Benson Wells & Co, now Corne Jantz and Associates. Mr. Benson’s credentials include being a CPA*, Certified Management Consultant, and Chartered Global Management Accountant. He is also the author of STAND FIRM WITH GOD’S POWER IN BUSINESS and numerous business and spiritual articles. Bob is married and has two sons and four grandchildren.